Health Insurance and Autism Series. | ||

Are you new to the world of health insurance? Making sure that you understand some of the basic concepts and definitions can help you hit the ground running.

Insurance and Coverage

Health insurance is a contract that requires an insurer, often the insurance carrier, to pay some or all of an individual’s health care costs in return for a regularly paid premium.

Coverage, on the other hand, is the legal entitlement to payment or reimbursement for a specific procedure or treatment.

For example, even if a child with autism has health insurance, there may be certain treatments which are not covered, that is, the provider might not get paid or the parent might not get reimbursed. Federal and state laws each have mandatory minimum coverage requirements for health insurance plans that affect various plans in different ways.

Keep reading this article to learn how to tell what type of plan you have.

Carrier and Type of Plan

Carriers are companies that are licensed to sell insurance. In New Jersey, they include but are not limited to:

- AmeriHealth HMO Inc.

- Horizon Blue Cross Blue Shield of NJ

- Oscar Garden State Insurance Corporation

- Oxford Health Insurance Inc.

The New Jersey State Department of Banking and Insurance (DOBI) maintains a list of the carriers with individual health plans or health plans for small employers>>

Types of Plans

Knowing the three most common types of plans is essential to understanding your rights and maximizing your coverage. In a nutshell, types of plans are based upon who pays the claims.

There are several different types of health insurance plans.

Fully Insured

Fully Insured Plan

Fully Insured Plan

This is what most people think of when they think of health insurance.

If you have a fully insured plan, you enter (or, if you get insurance through your job, your employer enters) into a contract with an insurance carrier. Under that contract, you pay a premium to the insurance carrier and, in return, the insurance carrier pays covered healthcare claims.

You might still have to pay coinsurance, copays, and must meet any deductibles that apply to the plan.

Learn more about fully insured plans>>

Self-Funded

Self-Funded Plan

Self-Funded Plan

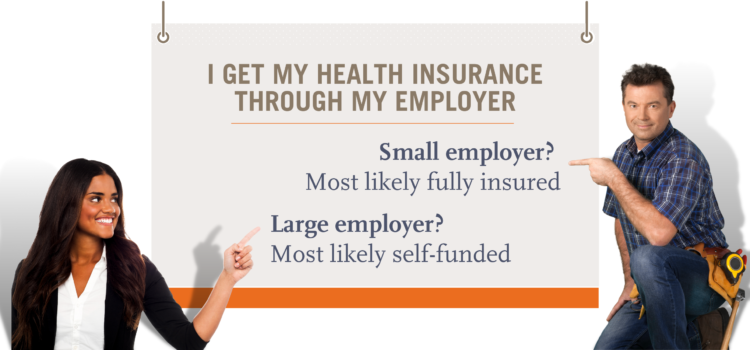

Self-funded insurance plans are typically provided by large employers or labor unions, and rarely by smaller employers.

They differ from fully insured plans in that healthcare costs are paid out of a fund that an employer establishes, and employees pay into.

The fact that the employer pays its employees’ healthcare costs does not mean that insurance companies are never involved in self-funded plans. In fact, many employers enlist an insurance company to perform administrative functions such as processing and paying claims. However, the insurance company is not paying the healthcare costs of the employees who enroll in the plan.

Learn more about self-funded plans>>

Public Health/Medicaid

Public Health Plan/Medicaid

Public Health Plan/Medicaid

If you have a public health plan, the government pays your healthcare costs.

One of the best-known examples of a public health plan is Medicaid. In New Jersey, Medicaid is also known as NJ FamilyCare and, while the federal and state governments jointly run the plans, they are administered by one of five Managed Care Organizations.

Find out more about NJ FamilyCare/Medicaid>>

What Type of Plan Do You Have?

If you have a copy of your insurance card, you should be able to tell what type of plan you or your family member has.

New Jersey law requires your insurance card to list the plan type.

If you have an employer-sponsored health insurance plan and your employer is headquartered out of state, your card may not list your plan type.

If you think you might have Medicaid (aka NJ FamilyCare), you can find out for sure by comparing your card to the images on the NJ FamilyCare website. Generally, your card will say “NJ FamilyCare,” “NJ FamilyCare A,” or list your group number as “NJFAMCAR.”

Need Help?

If you can’t figure out what type of health insurance you have, or if you have other questions about insurance and how to use it to cover autism diagnostic evaluations or applied behavior analysis, visit our insurance hub>>

Connect with an Autism New Jersey Helpline Specialist. Call 800.4.AUTISM or email information@autismnj.org.